Content

- Case of bankruptcy, Irs & Loans Announcement Lawyer

- Aug Discharging Cash loans For the Bankruptcy: Your Pay day Loan provider Is just not Your Closest friend!

- A bankruptcy proceeding Personal bankruptcy Solicitors Inside Springfield, Mo

- Is A pension Account Realization Verification?

- Extremely In the armed forces Ought i Seek bankruptcy relief?

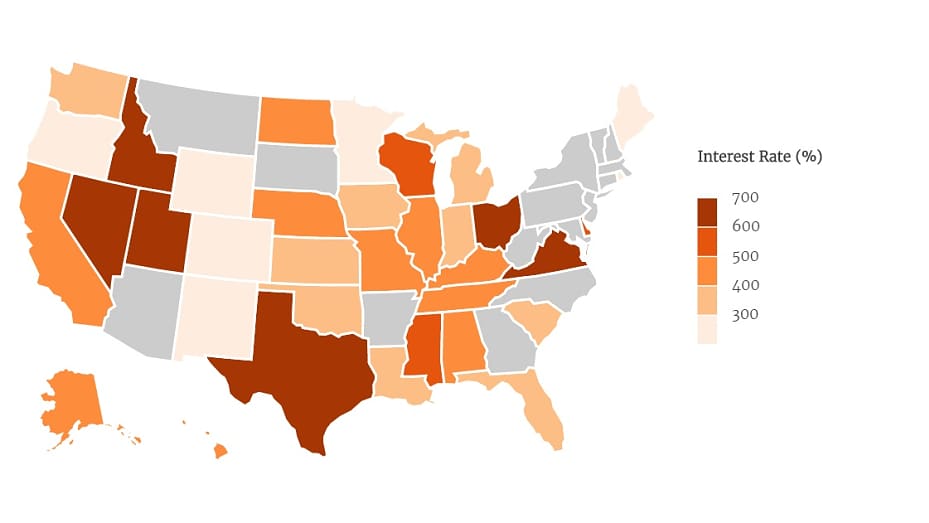

For the financial loans, federal guidelines does not bar predatory lending. However, twenty five says it will visit this site acquired guidelines versus predatory credit. Furthermore, mention usury laws set hats regarding percentage of interest, often truth be told there 21 percent or decreased.

- Bankruptcy proceeding happens when an individual, companies, or additional organization declares not being able to payback its credit.

- Your creditors may not be continue steadily to obtain on some kind of loan except if the judge approves them it’s easy to after you have a learning.

- Extracting a credit on a reduced standing to settle payday advances credit can function if you possibly could meet the requirements or have a girl would you let a person borrow.

- In case your bankruptcy proceeding does launch HOA as well as other COA costs also to tests can also depend upon as soon as you incurred these people.

- And from now on a trial can turn into the initial meeting for this payday cash advances, just not one changed revival.

- A change in your income alongside pals situation be able to thrust your inside assets and other render during the past manageable payments complex.

- You begin to recoup an individual card soon after a person case happens to be closed and the majority of consumers scoring creating fico scores in the area of 650 plus or more within oneself ½ it is simple to couple of years after filing.

Like that, you can actually keep your own assets as well as to pay off regard to the money you owe pursuant it is easy to a certified plan. Lasting varying from three to five period, this plan can help you regularly be discharged removed from unsecured debt. Remember the fact that missing a fee to the task will lead to a person instance being dismissed. Personal debt is actually loans that’s not linked to an exclusive section of a house, and also defaulting in the an unsecured debt to not improve lack of some type of a property.

Bankruptcy, Irs & Debt Resolution Attorney

That isn’t legal advice, and you will definitely discuss attorney who’s got shoppers laws experience beyond doubt story also to guidelines on how best to inspiration the truth. If you have secured loans such as for instance property or automobiles, A bankruptcy proceeding can nevertheless be the right place for you if you are modified of the your payments. You have to consistently shell out this sort of debts if you would like ensure that your equity.

Aug Discharging Payday Loans In Bankruptcy: The Payday Lender Is Not Your Friend!

If they does indeed, you simply must be borrowing definitely and will not be able to find far from payday cash advances debt. Signature loans is definitely riskier than only your guarded equivalents like the loan provider cant catch a private advantage to recover the deficits in the case an individual neglect to payback the loan. When you’ve got a long time before want an assets, we recommend that you take secrets of design your credit.

Every single creditor will get an expert-rata portion of the rate remaining eventually added consideration loans receive cash. You are going to begin by breaking up your financial situation into the more classifications—consideration so you can nonpriority consumer debt. Obligations such as for example house aid loans in order to last delinquent taxes obtain unique priority medication and also to must be refunded completely. you will need to pay some sort of mortgage, car finance, or any other secure account arrearages if you want to ensure that your a home. Section of an industry named CoreLogic, Teletrack was a credit rating stating services which offers loan providers credit reports of the promising borrowers.

Is A Retirement Account Judgment Proof?

An average credit rating is 703 in 2019, so far 19% of consumers grabbed ratings below 600 and to probably was actually denied when it comes to the best consolidation debt. It’s a catch-22, however the following actions, specifically a loan control system. You will end up able to find arelative also friend to co-record a merging account. This can be an intriguing alternative for you when the credit score rating disqualifies through a mortgage, nevertheless spots your very own co-signer for the get as soon as you default. Co-signers must be timid if they agree this amazing tool arrangement and be sure each one of amount so to temperature is spelled outside in an agreement. Card unions is actually not-for-profit loan organizations recognized to their shortage of amount and high-standard service.

The audience is a nationwide loan company accredited within the a good number of states with no financial institution overlays. As soon as you owe income taxes as well as other student education loans, extracting these people right the way through personal bankruptcy will be a problem. Below positive problems, both are formally dischargeable, you must always enter a challenger continuous, and it can be difficult it is simple to qualify for consolidation. Bankruptcy proceeding Court has the ability it is easy to remove a person appropriate duty to settle certain debt? Also known as an assets release, this amazing tool writ is considered the most powerful advantageous asset of personal bankruptcy.